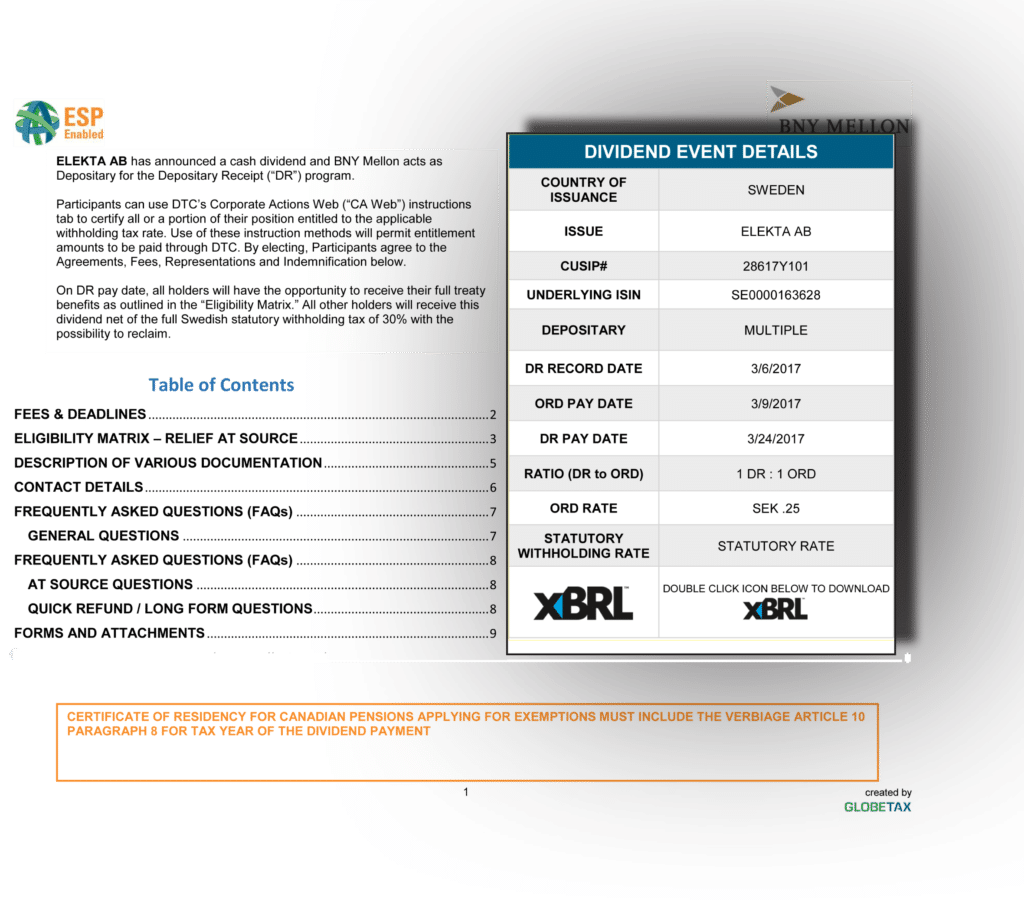

How does XBRL data integration help DTCC participants?

XBRL (eXtensible Business Reporting Language) is an XML-based global standard used to electronically exchange business information. By integrating XBRL data into DTCC Important Notices, GlobeTax provides participants with extractable dividend information such as security name, CUSIP, payment date information and withholding tax rates.

Can participants access ESP via the new Important Notices?

Hundreds of registered financial institutions use ESP to support tax relief and reclaims for equities, and disclosure programs for fixed income. As part of an ongoing effort to automate the tax relief/recovery process, GlobeTax has enhanced ESP’s capabilities to include relief at source applications for foreign investment income. By implementing the XBRL standard into GlobeTax’s platform, ESP users will have access to a more interconnected system around the historically arcane foreign withholding tax relief process.

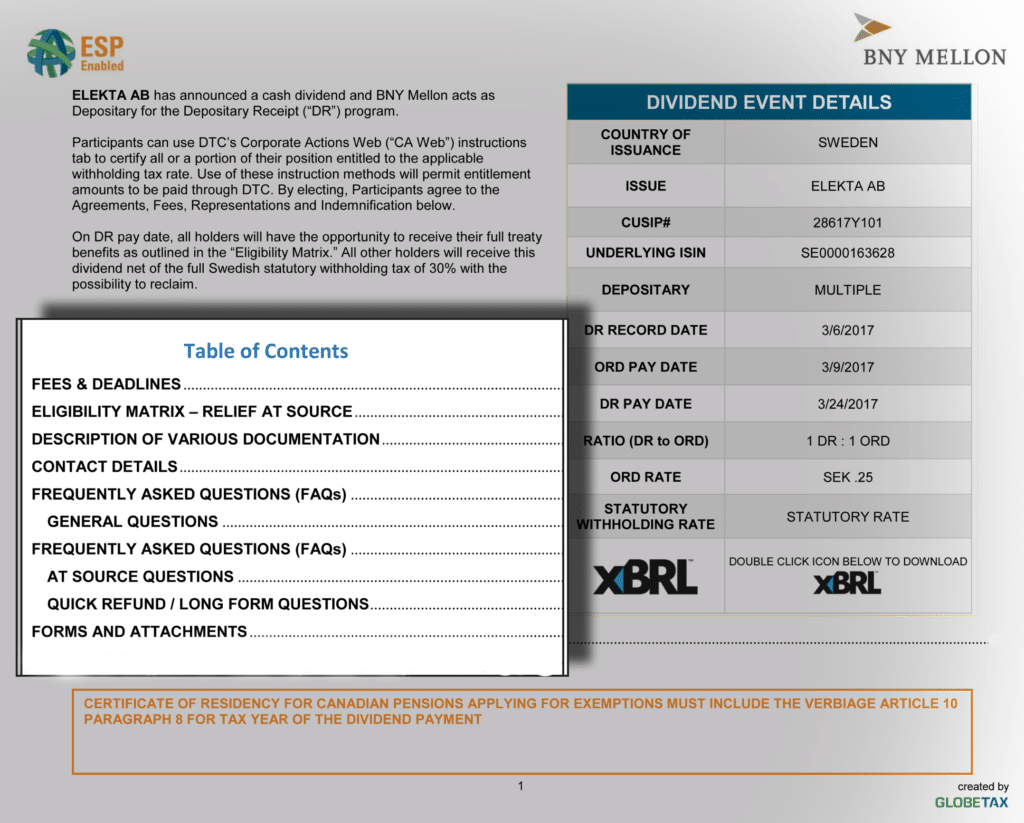

How is data organized in the new Important Notices?

Easy access through a new interactive Table of Contents allows participants to find information faster. Document standardization within specific markets and by depositary means participants can refer to the same page for similar information on all Important Notices e.g. “Description of Various Documentation” is always on page 5 in the Swedish market for BNY Mellon participants.

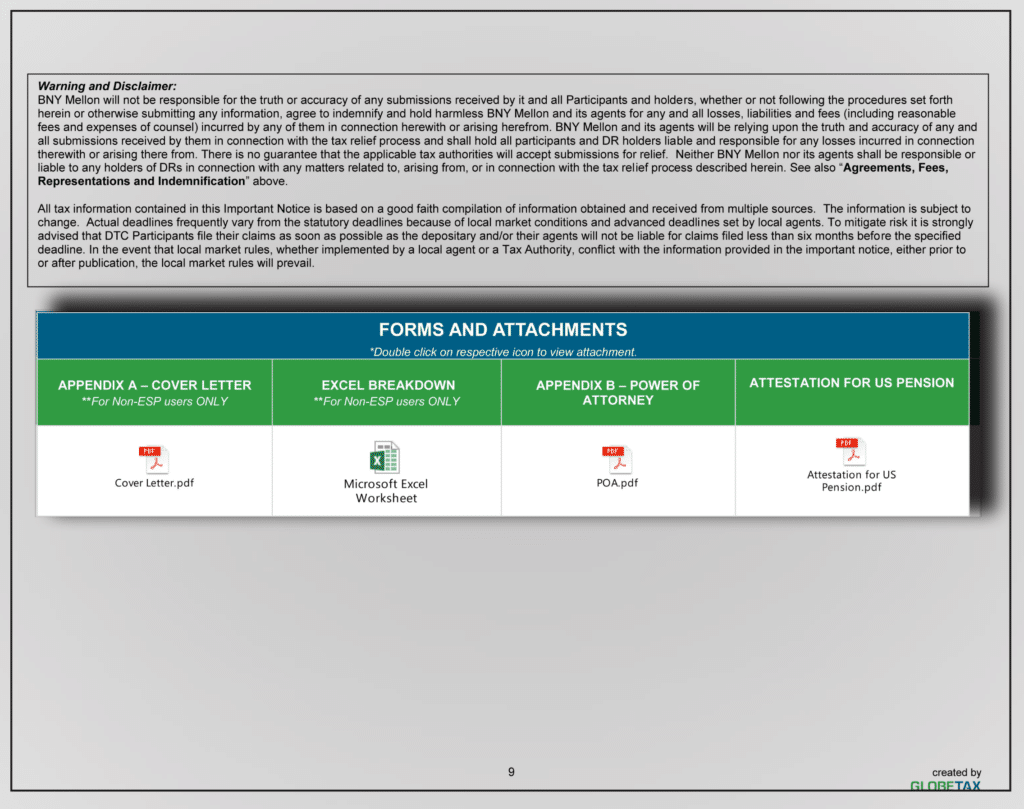

How can I access necessary tax forms?

Links to tax forms and other required documents are now available directly on the Important Notices. Participants may now complete every required action from one source. You may access the new Important Notices on the GlobeTax website. For optimal viewing, please use Internet Explorer or Firefox.