When it comes to money transactions, people and businesses have historically relied heavily on institutions (i.e. banks, government agencies, etc.) to act as intermediaries. But can we move away from this old-fashioned, centralized architecture of money?

What is blockchain?

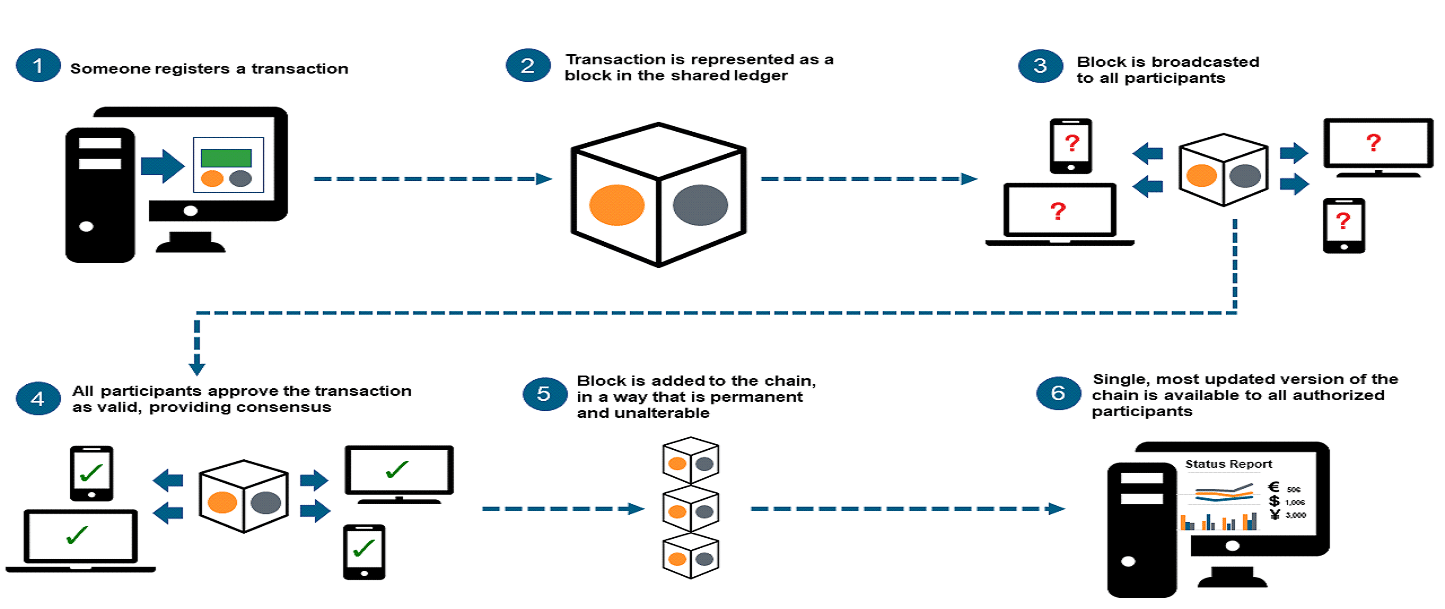

In the simplest terms, a blockchain is a growing list of records, or “blocks,” that are linked using cryptography. Blockchains use distributed ledger technology (a database synchronized across multiple sites, institutions and/or geographies) that is accessible to anyone.

Blockchain technology can eliminate the current system of transactions in which every party involved has their own record of a transaction. Instead, it creates a single, unalterable record secured over a digital network.

Terms to know:

- Block: growing list of ordered records/data

- Hash: uniquely identifies a block and all of its data – can be compared to a fingerprint. Changing data within the block will, in turn, change the hash.

- Distributed ledger technology (DLT): a database consensually shared and synchronized across networks spread across multiple sites, institutions or geographies.

Why is everyone talking about it?

For the first time in the marketplace, blockchain presents a distributed network that requires consensus about transactions. At the same time, blockchain creates an instant, efficient, and secure record of those transactions. With blockchain, real-time transactions are a possibility (even across borders), in a “verifiable and permanent way.”

Currently blockchains are mostly used as cryptocurrency ledgers, but there are a number of potential applications being explored in a variety of industries. These include:

- smart contracts that can be executed with little or no human interaction

- public and transparent ledger for sales data

- use and payment tracker for content creators

- online voting

Banks are particularly interested in blockchain technology as a way to increase efficiency – particularly for back office settlement systems – and drive costs down.

How does it affect tax recovery?

Blockchain technology has the potential to make tax recovery information exchanges, processes, and transactions much more straightforward. Historically, tax recovery has been notoriously complex due to factors like ever-changing, country-specific documentation requirements, scrutiny from tax regulators, and increased audits. A successful claim often requires liaising with one or more counterparties in the global custody chain, whether the foreign tax authority, global custodian, withholding agent, broker, depositary, or in-country agent bank. But can data be transferred through the custody chain in a more secure, faster and transparent way?

With Blockchain technology, the answer could be “yes, at some point.” Blockchain might provide a new level of efficiency to the record keeping, monitoring, and reconciling required for a successful withholding tax claim. That said, to be effective, all the different counterparties – from securities issuers, through a variety of intermediaries (custodians, CSDs, ICSDs, brokers, transfer agents, reference data vendors), to the tax authorities, – all in different jurisdictions, would all have to agree on digital implementation standards that just do not exist today. It is also unlikely that blockchain would be used in a completely open manner even if such standards existed. It is more likely to be established as a private permissioned network of the aforementioned interested counterparties. Blockchain has seen rapid adoption in the payments industry and as a base for crypto currencies, but we believe that it will be some years before the withholding tax industry is ready for blockchain.