How much are you leaving on the table?

This question is often misunderstood, and underestimated when asked of the public retirement system community. When investors hold international stocks in their portfolios, including American Depositary Receipts (ADRs), the dividends earned on these positions are often taxed at a high rate — varying by country but typically 20% to 35%. Depending on country of residence, an investor is likely to be eligible for a refund of some of this withholding, and pension plans may be eligible for a full refund in a number of major markets. In the current investment climate of shrunken returns, every basis point counts. A drag on performance attributed to withholding tax is meaningful and funds modeled around major benchmarks typically can add 30 to 55 basis points of risk-free performance simply by reclaiming over-withheld tax. This is significant for the pension community since they are often working in an environment of underfunded liabilities to their beneficiaries and the fund. Further, because of their tax-exempt status, pensions are not eligible for tax-credits that would offset excessive foreign withholding, as is common for taxable investing entities and individuals.

Full refund?!

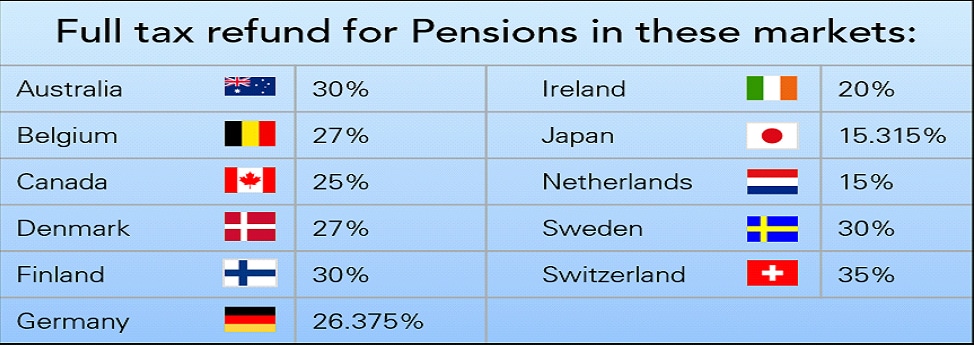

Sounds great right? It is. And, as illustrated in Exhibit 1, countries acknowledging tax-exemption include a number of the most popular markets for foreign investment by U.S. pension funds. However, the burden is on investors to submit these complex claims of residency and stock ownership directly to the foreign tax authorities, usually a difficult and time-consuming process. Certification of residency with the IRS can also be difficult and lengthy, and must be renewed annually in order to file tax reclaim applications. Investors may also encounter difficulty working with their custodian or broker, since this function is often not supported by the financial institution. While it is logical to assume that an account holder’s custodian, broker, or advisor is performing these tasks, the opposite tends to be true. Most recently, however, as the definition of fiduciary has evolved, the Department of Labor has spotlighted this activity.

DoL Audits?

Fiduciary responsibility. During a breakout session at the 2016 NCPERS conference held in San Diego, GlobeTax Executive Director Brian Sapadin spoke on the issue of withholding tax related to employee retirement plans. “From our experience, the DoL’s stance is that if an entitlement exists to recapture withheld taxes, plans should seek to avail themselves to the double-taxation treaties.” For public pension funds not subject to ERISA, there remains a clear fiduciary duty to engage in best practice and make every reasonable effort to recover treaty entitlements. If no action is taken, ultimately the Statute of Limitations will pass and the funds will be forfeited to the foreign tax authority. Mr. Sapadin noted that GlobeTax has seen a surge in new business from pension clients as a result of the broadening of fiduciary responsibilities, and has worked with several of these clients to assist them in providing the DoL with back-up documentation to fulfill audit requirements.

What Should You Do?

If no action is taken by investors, these entitlements will eventually expire, and will ultimately serve as donations to foreign governments. To ensure that proper measures are being taken to maximize your entitlement recovery, speak with your tax advisor, custodian(s), and fund manager(s) to confirm tax reclaims are being successfully completed. While some level of recovery work may be taking place, it is likely there are entitlements being left on the table that can be reclaimed, and further action should be taken to remain in accordance with industry best practice and help maximize performance of your fund.

Globe Tax Services, Inc., founded in 1992, provides international tax relief and recovery services to global investors and financial intermediaries. GlobeTax represents thousands of pension funds, as well as many other institutional and individual investors, lodging over 5.5 million reclaims per year. GlobeTax’s reclaim service for investors is an entirely contingent service with fees only paid by clients once funds have been successfully recovered.