Though they were created in 1927, Collective Investment Trusts (CITs) have taken off within the last decade. By late 2020, the asset class had reached an estimated market value of 3 trillion dollars. Now, nearly 42% of all target-date assets are invested in CITs — double the growth from was 5 years ago. The expansion shows no signs of slowing down due to the trusts’ low cost, unique regulatory arrangement, and movement towards greater transparency.

To explore CITs in greater depth, GlobeTax’s Len Lipton convened a group of experts from DTCC (Karin Billias, Director of Relationship Management), Nasdaq Fund Network (Devin McCarthy, Managing Director) and Alta Trust (Nathan Crisenberry, Chief Operating Officer) for a webinar entitled “CITs Take Center Stage.” The panelists explained how investors and CIT Providers alike can leverage this entity type to maximize performance and differentiate their strategy, offering a fresh take on a topic that is literally older than sliced bread.

Below, we summarize our takeaways from the conversation.

1. Ticker Symbols Promote CIT Transparency

The rapid growth of CITs has brought with it the increased need for transparency and reporting. Devin McCarthy, Managing Director at Nasdaq Fund Network, discussed how his organization has worked to provide searchable 6-character ticker symbols for CITs. As a result, participants can now search websites like Bloomberg and Yahoo Finance for information on CITs, facilitating transparency, categorization, and accessibility in the rapidly growing space.

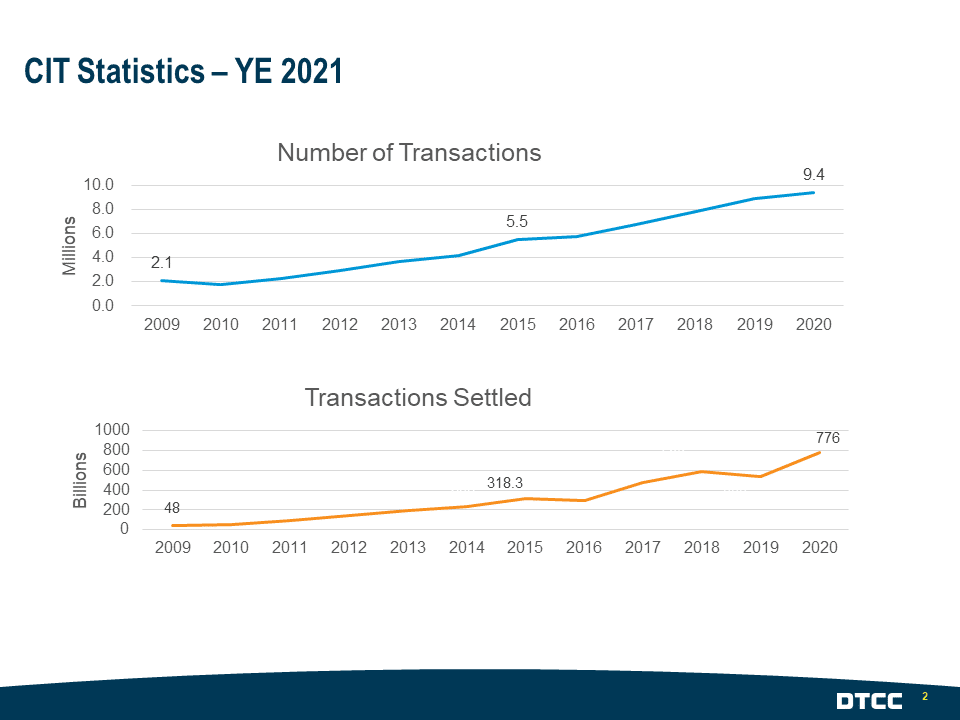

The move towards increased transparency could not come at a better time considering the recent explosion of growth. DTCC’s Karin Billias emphasized how the number of CIT transactions and amount settled increased by 347% and 1,500%, respectively, in the last decade alone.

Due to this rapid growth, CITs are steadily moving towards omnibus processing, consolidating many accounts to create one large account at the intermediary level. As this shift could bring complications, DTCC is developing innovations like a central data source to house operational rules (such as expense ratios) to ensure continued transparency.

2. Unique Regulatory Arrangements Keep CIT Fees Low

Nathan Crisenberry of Alta Trust noted favorable regulatory arrangements as a key factor underlying the massive growth of CITs. Although some believe that CITs are loosely regulated compared to similarly structured funds like mutual funds, Crisenberry corrected this misconception, clarifying that the Trusts are federally regulated by the Office of the Comptroller of the Currency (OCC) and additionally overseen at the state level by the appropriate division of banking. CITs managing money for qualified ERISA investors are also subject to oversight from the US Department of Labor.

The crucial difference between CIT and mutual fund regulatory arrangements, however, is that regulators do not charge a substantial fee for CIT oversight, resulting in cost savings of 10% to 40%, which companies like Alta Trust pass along to savvy investors.

3. Tax-Exempt CITs Can Benefit from Tax Reclamation – If They Take Action

Although their tax-exempt status entitles CITs to recover all over-withheld tax on foreign investments, many fail to capture these benefits. As foreign tax authorities require proof of tax residency for all nested accounts holding international investments, the recent move towards an omnibus structure has complicated tax recovery. It is difficult, but not impossible, to secure documentation for all the underlying holders. Crisenberry suggested that CIT providers can benefit from leveraging a third-party tax reclamation provider who specializes in transparent entities (like GlobeTax!) to resolve this issue, as such firms enjoy subject matter knowledge and devoted operational resources that other CIT service providers do not possess. Moderator, GlobeTax’s Len Lipton, certainly agreed!

As CITs grow and evolve, GlobeTax will continue to monitor the conversations surrounding the intersection of transparency, technology, and regulation in the space. We look forward to witnessing continued change in this dynamic industry and keeping abreast of the implications for tax recovery.

If you weren’t able to attend the webinar, click the button below for instructions on how to watch the recording.