Uncertainty is growing about the future of several financial regulations under the new administration. There are several pending lawsuits challenging the Department of Labor’s (DoL) Fiduciary Rule. At the same time, however, the new administration ordered a review of the rule in a recent memorandum, leading many to wonder if it will ever come into force. Despite the uncertainty around the rule’s future, recent focus on fiduciary duty has underscored the value of excess foreign withholding tax recovery – a risk-free way to maximize returns.

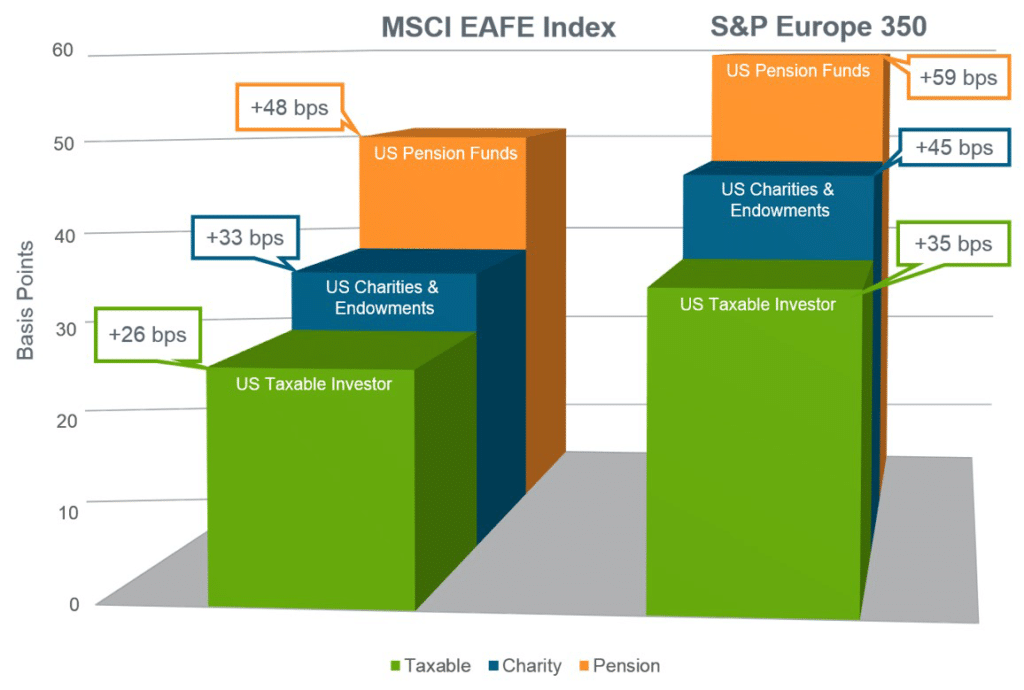

There has never been a question that foreign tax recovery demonstrates prudent management of assets and meets fiduciary standards of care. Recovery of excess tax also significantly enhances portfolio performance. As illustrated below, pensions are uniquely entitled to greater levels of recovery under more favorable treaty rates.

DoL Audits

Pensions undergoing DoL audits in the past have found that tax relief efforts have been explicitly reviewed. Many times trustees were not aware they were leaving money on the table and, therefore, not meeting their fiduciary standard of care. Foreign tax reclamation will continue to play a significant role in future audits. GlobeTax has helped several pension trustee boards cited during audits to submit evidence that funds were recovered to close an audit.

A recent Fortune Magazine article notes that despite the rule’s uncertainty, lawyers are advising their financial services clients to continue preparing for the April 10 deadline. Acting U.S. Secretary of Labor Ed Hugler also released a statement on the DoL website noting that the agency “will now consider its legal options to delay the applicability date as we comply with the President’s memorandum.” Regardless of the fate of the Fiduciary Rule, tax reclamation for pensions meet a fiduciary duty for trustees (which has always and will continue to apply without regard to the rule).

Tax reclamation and other methods of entitlement recovery should be a critical element of any pension funds’ investment strategy. In a time of uncertain investment returns, recovering excess withholding tax recovery is a risk-free tool that improves performance.